by Rob Murchison

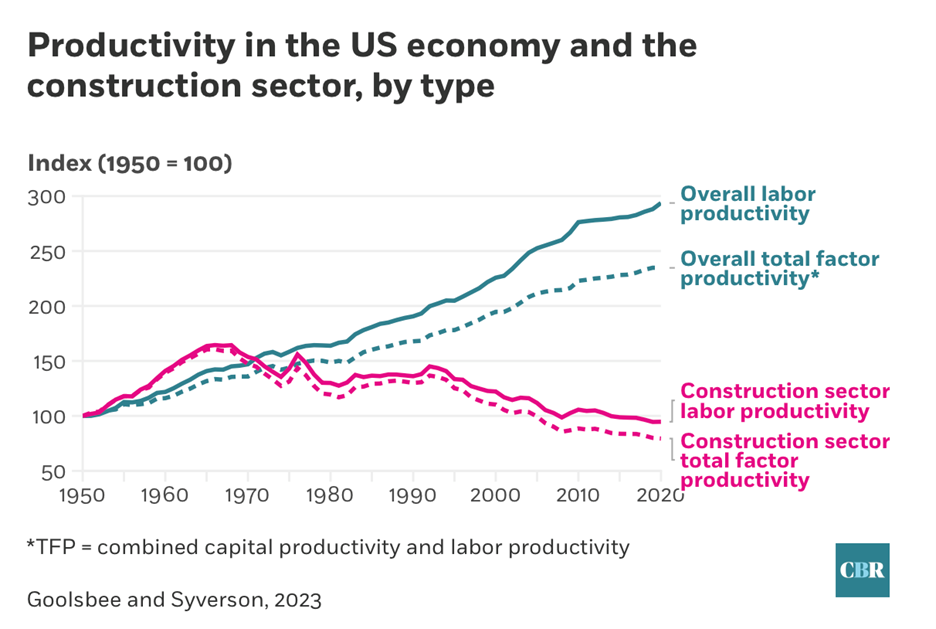

On Wednesday, the Federal Reserve’s decision to reduce the benchmark federal funds rate by 50 basis points also indicated a shift toward a higher neutral interest rate* in the post-pandemic period. This systemic change will continue to significantly alter the cost structure of operating commercial real estate (CRE).

A silver lining exists with rising financing and operational expenses—fueled by increased labor costs. Technology already installed in most buildings can unlock significant efficiencies, lower costs, and enhance tenant experiences. By fully utilizing these systems, CRE owners can create long-term value despite financial pressures.

*The neutral rate is the “just right” interest rate that helps keep the economy on an even keel, promoting stable growth without causing problems like high inflation or high unemployment.

Here are some of the ways you can leverage the existing technology inside your buildings to navigate those rising costs:

1. Predictive Maintenance: Reducing Costs and Preventing Downtime

Unplanned expenses are especially painful when the cost of capital is high. Predictive maintenance is available in most modern individual systems and provides a proactive approach to managing building systems.

- Current Impact: Higher interest rates mean funding repairs or new systems is more expensive. Unexpected failures can disrupt tenant operations, leading to dissatisfaction or vacancies.

- Solution: Continuously monitor their health and use built-in diagnostics in packaged equipment such as rooftop units (RTUs) and variable frequency drives (VFDs). Early detection reduces the risk of costly repairs or replacements.

- Example: Use the diagnostics built into the VFD to monitor and baseline the electrical current in the motor and watch for any signs of deterioration. Predictive maintenance could reduce HVAC downtime by up to 70%, reduce repair costs by up to 30%, and extend equipment lifespan by up to 20% in a large multi-tenant office building.

2. Automated Fault Detection and Diagnostics (AFDD): Enhancing Overall BMS Efficiency

Stimulus-driven inflation and a shortage of skilled building tech workers are driving up labor costs, making operational efficiency even more critical. AFDD improves broader building management systems (BMS) by optimizing key interdependent functions such as heating, cooling, lighting, and security through holistic algorithms that leverage broader data sets.

- Current Impact: Underutilized automation results in inefficiencies and increased operating costs, compounded by rising inflation-related labor costs.

- Solution: BMS enhanced by AFDD can reduce energy consumption by optimizing system health based on real-time data (e.g., adjusting HVAC settings based on occupancy patterns). It also cuts labor costs by automating repetitive tasks such as alarm management that would otherwise require continuous monitoring by facility staff. Additionally, by looking for patterns across all connected building systems, AFDD allows for centralized optimization, reducing the need for as many on-site personnel as possible. If you are looking for a framework to take advantage of this, the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) offers Guideline 36 to speed up your path to results.

- Example: A 500,000-square-foot commercial building could see energy savings of 15-20% annually. Additionally, the automation can reduce payroll expenses, providing a buffer against inflation.

3. Technology-Driven Tenant Services: Boosting Satisfaction and Retention

Tenant expectations are evolving, and existing technology can play a pivotal role in meeting these demands while reducing operational costs. Technology-driven tenant services (e.g., mobile apps for work orders, booking amenities, or adjusting workspace environments) streamline the tenant experience and reduce administrative overhead by overlaying on top of the existing technology within your buildings(s).

- Current Impact: Tenants are cost-conscious and seek higher value.

- Solution: By offering tenants more control over their environment (e.g., via an app to adjust lighting, book meeting spaces, or report maintenance issues), property owners can improve tenant engagement and reduce friction. These services also decrease the administrative burden on property management teams, allowing them to operate more efficiently.

- Example: A building implementing a tenant app can see up to a 25% reduction in tenant-related service requests, allowing property management teams to focus on higher-value tasks. This translates to better tenant retention and lower turnover costs, directly impacting NOI.

Act Today

A higher neutral interest rate means elevated borrowing costs will persist. Operating expenses will play a crucial role in maintaining profitability.

- Tech Debt—The Cost of Inaction: In a higher interest rate environment, technical debt within a building could likely grow, exacerbated by deferring investment in technology or, worse yet, investing in new tech that often ends up underutilized while also being at risk of hacks from the bad guys. Property owners who do not persuade their in-house or third-party operators to utilize existing building technologies will experience increased operating costs, decreased tenant satisfaction, and reduced asset value over time. The inability to efficiently manage costs may result in unexpected budget expenses, potentially leading to resistance from tenants against rent increases, resulting in higher vacancies and turnover.

- Value of Technology Adoption: Conversely, owners who educate themselves and invest in these economical solutions now will be better positioned to stabilize costs, even as post-pandemic interest rates remain higher. By automating processes, optimizing maintenance, and enhancing tenant services, you reduce current expenses and mitigate the need for future capital expenditures.

Final Thoughts

Utilizing existing technology within your building(s) to its fullest potential, such as predictive maintenance in packaged units, AFDD of your broader BMS, and technology-driven tenant services, is a great way for CRE owners and asset managers to manage increasing costs, enhance tenant satisfaction, and boost asset value. In a higher neutral interest rate environment, these EXISTING technologies are no longer a luxury—they are necessary for maintaining profitability and staying competitive.

This is an exciting opportunity to leverage the existing technology in your buildings to stay ahead in the market. Assess your current systems, consult with experts as needed, and take proactive measures to enhance your operations. The investment needed is primarily time, as the technology is already in place in most cases, ready to empower your success.